A QR code payment system is a digital payment method in which customers scan the QR code of a merchant using their phone to make a payment. The code entails payment details such as the merchant's account details and the transaction amount. Upon scanning, the system charges the payment through the associated payment gateway, e.g., a bank, online wallet, or online payment processing service.

QR code payments are transforming the payment landscape of transactions through ease of use, security, and availability. They have enabled businesses to accept payment through QR code smoothly and consumers to make payments with a swipe of their phone. This guide will help you generate and utilize QR codes to make payments, with several QR code payment companies explained.

Table of Contents

- How QR Code Payment Works?

- Types of QR Code Payments

- The Benefits of QR Code Payments

- How to Create a QR Code for Receiving Payment

- How to Make a Payment using QR Code

- Is QR Code Payment Safe?

- Best Payment QR Code Options for Businesses

- Pricing Plans for QR Code Payments

- What Real Users are Saying About QR Code Payment

- Key QR Code Payment Growth Statistics

- Future of QR Code Payment

- Why IMQRScan is the Best QR Code Generator Review

- Why QR Code Payments Are Shaping the Future of Transactions

How It Works:

- The merchant prepares a QR code tied to the merchant's payment gateway and displays it.

- The customer then uses a mobile phone to scan the code, typically a payment application such as Apple, PayPal, or a cryptocurrency wallet.

- The amount is verified and paid by the customer.

- The payment has been completed, and the customer and the merchant are confirmed.

How QR Code Payment Works?

QR payments simplify and speed the process of costs for both consumers and vendors. On the consumer side, the procedure starts with opening a mobile-based payment application, like PayPal or a digital wallet, and scanning a QR code of the vendor during checkout. The payment information is shown instantly, and with a single tap, the transaction is sealed. It is guaranteed by a real-time confirmation that ensures smooth and safe payments.

It is also not difficult when vendors do it. Once they have signed up with a QR code payment platform that accepts QR payment, they can provide a different QR code per sale or a fixed QR code that can be used repeatedly. It is possible to manifest this code in a receipt, web page, or even on the countertop. When the customer approves the scan, the vendor is immediately alerted, and all transactions can be tracked by the provider on the dashboard.

The Benefits of QR Code Payments

QR code payments offer fast, secure, and contactless transactions that improve customer convenience and reduce costs for businesses.

Convenience:

The payments made with QR codes are convenient and quick. Unlike physical cards and cash, it does not require customers to take time to pay in several seconds; instead, all they need is an easy scan of a QR code.

Security:

QR code also provides a safe payment means as the data transfer is encrypted. The payment information can only be accessed by the recipient, which reduces the risk of fraud. Add-on layers of security, such as biometric verification and tokenization, are often added to many QR payment platforms.

Cost-Effectiveness:

To businesses, QR codes are cheaper to use compared to a traditional POS system with QR code payment because they do not require special hardware or card-reading devices. This reduces the cost of transactions and the setup.

Accessibility:

QR codes are a convenient method of payment for those with internet access and a phone. It is specifically helpful in areas where the traditional bank QR code payment infrastructure is underdeveloped.

Types of QR Code Payments

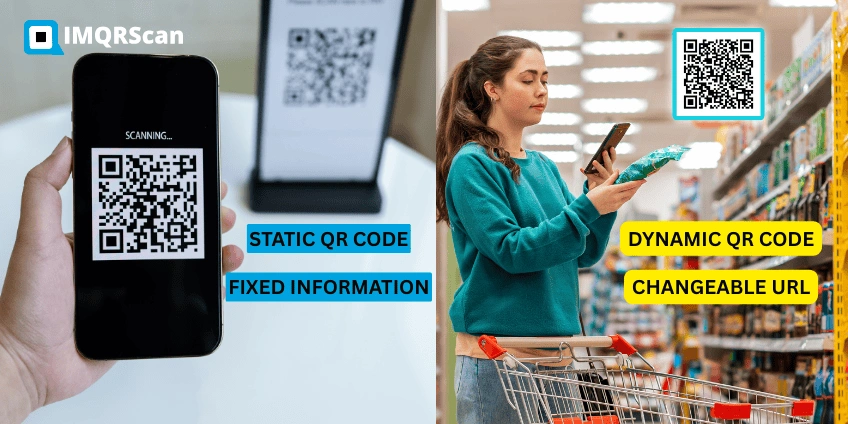

Here is the explanation of Static vs Dynamic QR Code Payment:

Static QR Code:

These QR codes are non-editable, and they have a fixed amount of information. And they are handy in isolated transactions or where quantity does not vary. As an illustration, the QR code for donations or a bill payment can be printed on a business card.

Dynamic QR Codes:

The codes are real-time updatable. They are applicable in making transactions where the amount of money that will be paid can fluctuate, as it does in a retail store. Each time a dynamic QR code generator is used for payment, it contains a unique link to deliver the payment.

Merchant QR Code Payment Flow (Specific to Singapore)

In Singapore and other countries, the SGQR system allows combining different types of payment (e-wallets, bank accounts) into one QR code. This is a universal code that makes it easy to identify the transaction process and enables merchants to receive payments across several platforms.

Step-by-Step Guide: How to Set Up a QR Code Payment

Select a QR Code Generator:

Choose a trusted and safe tool, IMQRScan, which is available on different payment systems. Some even provide an All-in-one QR code generator for payment.

Register an Account

Create the account in the payment processor (PayPal, Apple Pay, or a crypto payment provider). Combine this profile with your QR code generator.

Create QR Code

Fill in the necessary information, e.g., your payment account numbers and the amount (if fixed), or keep it dynamic for variable amounts.

Set up with Your POS System

In case you have a physical outlet, combine the QR code with your POS system. In some cases, you may need extra software or hardware, depending on your configuration.

Try the QR Code

It is always good to conduct a test on the QR code before putting it to practical use, so that when a customer is making their transaction, they can easily transact.

How to Create a QR Code for Receiving Payment

How to Collect Reviews

Step 1: To get started, select a Payment Gateway

Choose a payment processor that has QR code payments (e.g., PayPal, Stripe, or a crypto wallet). Ensure that the provider integrates well with your business system.

Step 2: Create your QR Code

The majority of payment gateways provide a possibility to generate a payment-specific QR code. All the information needed for the transaction will be provided in this code.

Step 3: Show Your QR code

After it has been generated, you may load the code on your site, in-store, or on an invoice. It is a code that customers can scan to pay.

Step 4: Scan your QR code

It is crucial to test a small payment before making a payment to a customer to ensure a smooth transaction.

How to Make a Payment using QR Code

Please Open your Payment App

Start an app for payment like QR code payment Apple Pay, use Google Pay, or any crypto wallet.

Scan with QR Code

Direct your phone's camera at the QR code displayed by the merchant.

Confirm Payment

Payment amount will be auto-populated. Then, use your preferred method: PIN or password to authenticate.

Transaction Confirmation

Once confirmed, the merchant will get a notification, and you'll have the receipt for the transaction.

Is QR Code Payment Safe?

On the whole, QR code payments are safe, as they have robust security features to protect payment information. All our payment data is encrypted, so it's accessible by the intended recipient only. Many systems also ask for authentication from fingerprint, face scanning, or PIN before approving any payment. Tokenization replaces your real credit card or banking information with a secure digital token. Because of this, a merchant never sees or stores your real financial information.

However, threats like scamming QR codes should be notified to users as an awareness of phishing. Among the events, police from Singapore reported cases in which staff installed fake QR stickers over the authorized ones in car parks. Unsuspecting motorists scan them and enter card details, only to find out that they have lost cash. Therefore, always verify QR codes beforehand and only use QR codes from trusted companies or official apps.

Best Payment QR Code Options for Businesses

The best payment QR code for business code payments has changed how people can pay worldwide. Instead of cash-carrying or card-swiping, all a customer needs to do is scan the QR code and confirm the payment on the phone. The whole process is quick, safe, and widely accepted by wallets and even cryptocurrency platforms. Next, we will discuss a few QR payment systems that are widely used.

PayPal QR Code Payments

PayPal provides QR codes so that both individuals and small businesses can easily accept payments. A merchant can log into their PayPal account, generate a QR code, and display it at their store or online. The customer opens the PayPal app, scans the code, and approves the payment; the money is then sent directly to the merchant's PayPal account. This option is beneficial to freelancers, delivery, and local shops who want a trusted and world-recognized payment option without having to set up complex systems. For example, the New York food truck might have a PayPal QR code posted at the counter, allowing customers a quick and easy payment without handling cash.

One can also create a PayPal QR Code with IMQRScan.

UPI QR-Code Payments in India

In India, UPI has been the backbone of QR code payments. A merchant generates a QR code linked to its UPI ID using apps like PhonePe, Paytm, or Google Pay. A customer can simply scan the QR with their banking or wallet app and authorize the transfer, which will directly transfer funds from their bank account. UPI QR codes are in use from street vendors to malls since customers prefer them.

WeChat Pay QR Code Payments in China

In China, QR code payments are synonymous with WeChat Pay and Alipay. These allow payments, often in the form of daily transactions, by scanning the QR code: one can shop in a grocery store, pay for a cab, or even pay a bill for dining. Vendors display their individual Wechat QR code on the counter; a customer merely needs to scan it through their app to make a payment. There is a considerable hype about using QR codes that turned these platforms with really huge user groups into a normal thing of culture that has almost eliminated cash in several cities.

Brazilian Pix QR-Code Payments

Pix, created by the Central Bank of Brazil, is an instant payment system that has almost entirely modified the digital transaction mechanism in the country. Any user with a bank account can instantly generate or scan a Pix QR code to send or receive money at any time, even beyond banking hours. Pix allows instant transactions at very low rates or free of charge. This is especially advantageous to small vendors who require immediate access to their funds. For instance, in the city of São Paulo, street vendors usually rely on Pix QR codes to receive instant payments without the threat of prolonged delays or costs. With well above 150 million Brazilians having joined Pix, it thus stands out as one of the most successful QR code payment systems in the world.

Cash App QR Code Payments

While Cash App is almost a household name in the United States, it also allows QR code payments. Merchants or individuals can generate a QR code from their Cash App profile so that others can scan it to send money instantly. Cash App differs from other payment methods in that there is no need to give up one's phone number or email address, which makes transactions more private and easier to complete. For example, a local artist selling handmade jewelry at a market can put a Cash App QR code on their table, allowing the customers to scan it and pay in seconds.

Zelle QR Code Payment

A widely used payment service in the United States also provides Zelle and QR code functionality. Users can generate a QR code within their banking app or Zele app. By scanning the code, the payment person can send the money directly from their bank account to the receiver's account. It is handy for small businesses or individuals who want to avoid tackling cash but also do not want to rely on a third-party wallet. With the integration of Zel in several major banks, QR code payment in the U.S. has become even easier and safer to use.

Crypto Wallet QR Code Payment

Cryptocurrency wallets also use the Crypto QR code to simplify transactions. When sending or receiving crypto, wallets such as Coinbase, Conance, or Trust Wallets produce a QR code that has a wallet address. Instead of typing a long and complex string of characters, users can scan the code to send or receive payment safely. This is not only sharp but also helps prevent errors in transactions. Many businesses that accept Crypto now display the Wallet QR code, making it easy for customers to pay with Bitcoin, Ethereum, or other digital currencies.

QR Code Payment in Different Sectors

- Retail: Retail businesses use the QR code to allow customers to pay for products through mobile apps.

- Food and drinks: Restaurants and cafes provide QR codes for quick bill payment, which reduces the requirement for physical contact.

- Education: Schools and universities use QR codes for easy payment of tuition fees.

- Healthcare: QR codes in clinics and hospitals enable patients to pay for medical services.

Pricing Plans for QR Code Payments

In IMQRScan, the QR code payment is affordable for all. Start with a free 7-day test at $ 0-Unlimited code, adaptation, and tracking, no card is required. Upgrade the starter plan at $ 2.99/month for unlimited scans, analytics, and branded designs - right for small businesses.

Why is it worth it?

Just an additional sale or happy returning customers can easily cover your monthly cost. Our pricing makes it possible to compete with large brands for micro-businesses, cafes, bakers, online vendors, and service providers at a fraction of the price.

With IMQRScan, you do not make only the payment QR code. You build trust, simplify checkouts, and increase your business without breaking the bank.

What Real Users are Saying About QR Code Payment

Switching was the best step ever! We replaced our old card machine and now use a QR code on the counter. There are no hidden fees, no tech glitches - just immediate payment for a direct account.

Pix QR changed my daily life. From rent to grocery items, I handle all my payments quickly, easily, and stress-free.

As a freelancer, I used to wait for days to be paid. Now, customers from different countries pay me immediately through the QR code. No delay, no worry.

Key QR Code Payment Growth Statistics

Junipar Research Projects states that the Global QR payment transaction will increase from $5.4 trillion in 2029 to more than $8 trillion by 2029, increasing by 50%. National QR schemes and payment interoperability power this boom. SOURCE

Future Market Insights estimates that the global QR code payment market will increase from $15.95 billion to $73.44 billion by 2035, at a stable CAGR of 16.5%. It shows a large-scale, long-term opportunity. SOURCE

According to Visa's global back to business study, 73% of small businesses in the survey stated that adopting new forms of digital payments - including QR codes - was fundamental to their growth. SOURCE

Future of QR Code Payment

As digital payments continue to develop, the QR code is expected to integrate more deeply in both physical and online transactions. We are seeing such trends:

- Blockchain integration: Cryptocurrency payments through QR code are gaining popularity.

- Global Adoption: QR code will be a standard payment method worldwide, especially in emerging markets.

- Promoted security: Future QR code payments will include enhanced security measures such as multi-factor authentication and AI-based fraud detection.

Why QR Code Payments Are Shaping the Future of Transactions

QR codes offer a safe, cost-effective, and convenient way to make transactions for payment businesses and consumers. Whether you are a small retailer or a large corporation, implementing QR payments can enhance your customer experience by streamlining your payment procedures. The future of payment lies in spontaneous, contactless solutions, and QR codes are at the forefront of this change.

Frequently Asked Questions

About QR Code For Payment

Everything You Need to Know About This Fun Prank

What is a QR code payment system?

A QR code payment system allows customers to scan the QR code of a merchant with their mobile phones and facilitates quick, cashless payment. Once scanned, the code directs the customer to a safe payment gateway, where they can complete the transaction using the linked bank account, wallet, or card, Popular systems include UPI in India, Pix in Brazil, and WeChat Pay in China.

How do I set up a QR code payment?

The setting is simple. First, choose the payment gateway or QR code generator that supports your payment method. Your Then:

1. Method: Register your account and link it to your bank or wallet.

2. Produce your unique merchant QR code payment.

3. Print or display the QR code on your shop, website, or challan.

4. Customers scan, pay, and you get immediate confirmation.

5. This method works for small shops, restaurants, freelancers, and even large retailers.

Is QR code payment safe?

Yes. QR code payments are safe as they use encryption, tokens, and authentication to protect the transaction. However, security also depends on scanning the reliable merchant QR code. Fraud code users can redirect to fake websites, so businesses should use verified QR code generators such as IMQRSCAN.

Can I use QR code payment with Crypto?

Absolutely. Many crypto wallets like Coinbase, Binance, and Trust Wallet allow you to send and receive money by scanning the QR code. This makes it easier to transfer bitcoin, or without typing long wallet addresses. For businesses, adding a crypto QR code expands payment options and attracts technology-loving customers.

What is The Difference Between Static and Dynamic QR Codes?

Static QR codes: Non-changeable, fixed in use, and are usually applicable in one transaction or small transactions. Dynamic QR codes: These QR codes can be edited and tracked. Businesses can modify the value or add analytics, and they can also use the same QR code to make subsequent payments.

What are the comparisons of QR Code payment with other payment methods?

QR code payments are also cheaper and faster in comparison to payments made by cards or cash. No costly machinery, card swipe charges, or hardware costs are required. QR transactions are quick at platforms such as PayPal, UPI, WeChat, Brazilian Pix, and Zelle, and they are the best solution for local shops and global e-commerce.

Is it possible to Connect My Credit or Debit Card to a Payment in QR Code?

Yes, the majority of QR code payment apps allow you to connect with a credit or debit card directly. The QR code payment is made on your registered plastic card. In this manner, you do not have to carry the card in your body or swipe it at a machine. To take an example, with the help of such devices as Apple Pay, Google Pay, and PayPal, you can safely store your card and use QR codes to pay anywhere that accepts them. It is secure, quick, and suitable for businesses that desire a contactless checkout method.

How to Use a Credit Card for QR Code Payment

Yes, the majority of QR code payment apps allow you to connect with a credit or debit card directly. This is how you can use a credit card for QR code payment securely.