UPI QR Code Generator to Accept Payments Instantly

Create secure UPI QR codes instantly with IMQRScan’s UPI QR Code generator. Simplify payments, accept money from any app. UPI QR codes allow companies to add quick and easy payments to invoices, receipts, or online checkout pages. Works with Google Pay, PhonePe, Paytm, and BHIM. Create UPI QR with preset amount and note in seconds.

Are you tired of entering UPI IDs by hand? Our UPI QR Code Generator helps you receive payments easily and quickly. If you're a business owner, worker, or just sharing expenses with friends, you can soon make your QR code and receive payments immediately.

Learn more about how UPI is transforming real-time digital payments in India in this European Payments Council insight . For recent adoption and usage trends, see this Economic Times BFSI report on UPI QR growth .

Need other tools? Try our File QR Code Generator or Multi URL QR Code Generator to explore more smart solutions.

Reasons to Choose Our UPI QR Code Generator?

Quick and Free:

Generating a UPI QR code has never been easier. With our tool, you can make one in seconds, and it’s free for seven days. You can start immediately by entering your information, and there's no need for complicated sign-ups or payments.

Safe and Trustworthy:

IMQRSCAN is the best UPI QR code payment gateway service provider. Our primary aim is to keep your money safe. IMQRSCAN ensures that your payment information is kept secure and private, protecting your transactions from anyone who shouldn't access them. We use top-security methods to keep your information safe.

Universal UPI QR Code Generator:

Our universal UPI QR codes efficiently work with all UPI apps, such as:

- Google Pay

- PhonePe

- Paytm

- BHIM, and others.

Your customers or friends can quickly scan and pay, no matter what device they use.

Personalised Choices:

We allow you to customize your UPI QR code by including the following data:

- Business name

- Set amount

- Payment message.

This makes deals easier and guarantees you get the right payouts with all the needed information.

How to Generate UPI QR code (Step-by-Step guide):

Step 1: Enter your UPI ID.

Please enter your UPI ID in the given space. This can be your UPI ID that is tied to your cell number or the one connected to your bank account.

Step 2: Enter Payment Information (Optional)

If you want to define a set amount, enter the exact figure. You can add a payment note to help your customers quickly see their payments.

Example UPI link (with preset amount & note)

You can also share a direct UPI deep link:

upi://pay?pa=merchant@upi&pn=Your+Store&am=250&cu=INR&tn=Invoice+123Replace merchant@upi with your UPI ID, pn (payee name) should be URL-encoded (spaces as +), am is the amount, cu is currency, and tn is the note.

Step 3: Generate QR Code for UPI.

Click the “Generate” button to quickly generate QR code with UPI ID. Then, you'll have quick access to a ready-to-use QR code without any waiting or delays.

Step 4: Download and share.

Save the QR code as an image and share it wherever you need, like on your website, receipts, store counters, social media, or directly with buyers.

Benefits of UPI Payment QR Code Generator

Transactions without hassle

Thanks to UPI QR codes, entering UPI IDs and sums by hand is no longer necessary. Your clients or friends may quickly finish the payment by scanning the code, verifying the amount (if predetermined), and completing the transaction.

Processing Payments instantly

UPI transactions are handled instantly, unlike conventional bank transfers, which might take some time. This guarantees that payments are made to you promptly and without any delays.

No Additional Charges

Because UPI transactions are typically free or have very low costs, they are a cost-effective choice for people, companies, and independent contractors.

Enhanced Convenience for Customers

Consumers value quick and easy payment methods. By providing a UPI QR code, you can lower payment process friction and improve client happiness and experience.

Compatible with Every Platform

Your QR code will still work regardless of whether your client is using an Android or iOS smartphone or tablet. The device or UPI app used guarantees that payments can be made with a simple scan.

Who Can Use Our UPI QR Code Generator?

Our tool helps anyone who needs a quick and safe way to get paid. Some typical users are:

- Small Business Owners: Accept digital payments at your shop, café, or website.

- Freelancers and Professionals: Make money easily for your services.

- NGOs and charities: Can gather gifts easily from their followers.

- Event: Get entry fees or funding money right away.

- Friends & Family: Share bills, pay rent, or settle costs easily.

Advice for Getting the Most Out of Your UPI QR Code Use

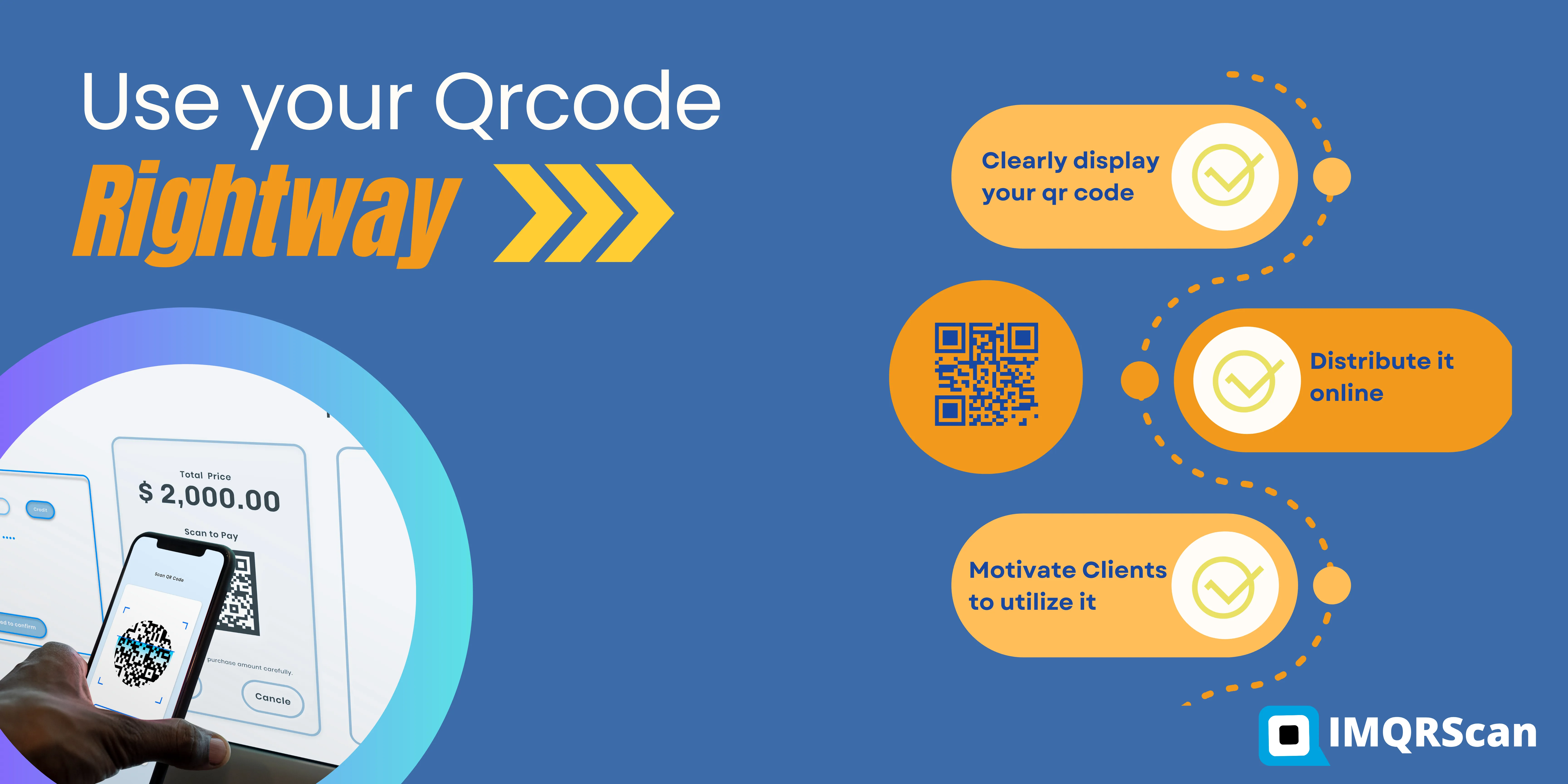

Make sure to clearly display the QR code:

Print the QR code and display it at your store counter if you're utilising it for commercial purposes.

Distribute It Online:

To promote digital transactions, use the QR code in emails, social media postings, and invoices.

Instant Payment Verification:

Keep your UPI app's alerts turned on so you can verify payments as they are received.

Motivate clients to utilize it:

Inform them that using your UPI QR code to make payments is simple and secure.

About the Author

The IMQRScan Editorial Team is a group of writers, and digital marketers passionate about QR technology, SaaS, and digital innovation. With expertise in QR code solutions and modern marketing strategies, the team focuses on creating content that helps businesses, creators, and professionals adopt smart tools for growth. Every article is fact-checked and reviewed to ensure accuracy, simplicity, and practical value for our readers worldwide.

Frequently Asked Questions

Have a question? Check out the FAQ

What is UPI QR code?

A UPI QR code is a scannable payment code that instantly transfers money between bank accounts using India’s Unified Payments Interface (UPI).

How UPI QR codes simplify payments?

UPI QR codes simplify payments by enabling instant, cashless transactions with just a quick scan—no account details needed.

How do QR code payments work for UPI transactions?

When scanned, a UPI QR code securely transfers payment details through the UPI network, allowing instant money transfer between accounts.

How to get UPI QR code?

You can get a UPI QR code from your banking app, payment service provider, or a trusted QR code generator like IMQRScan.

Can I create my own UPI QR code?

Yes, you can create your own UPI QR code using apps like BHIM, Google Pay, Amazon, PhonePe for easy payments.

Can I use UPI QR codes internationally?

UPI QR codes are primarily for domestic use in India, though select international partners now support cross-border UPI payments.

Can I add my company name and amount to my UPI QR code to make it unique?

Indeed! You can customize your UPI QR code by adding your company name and logo, establishing a preset amount, and adding a payment message. That is why IMQRSCAN is UPI QR code generator with amount.

Do scanning and payment need a unique UPI app?

No, all major UPI apps — including Google Pay, PhonePe, Paytm, and BHIM — work seamlessly with your UPI scanner QR code for instant payments.

Does utilising UPI QR codes to make payments have a transaction limit?

Yes, banks establish daily restrictions for UPI transactions. Depending on your bank's rules, these limits often range from ₹1 lakh to ₹2 lakh.